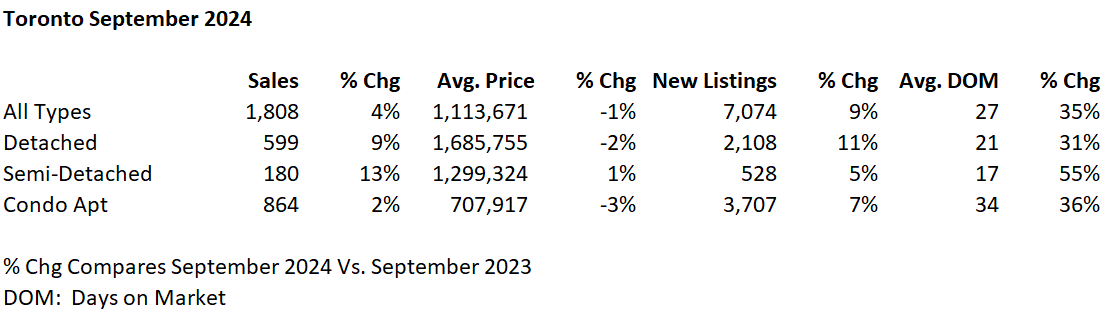

Toronto’s September real estate market was slow. Hopes of a strong fall market following a sluggish summer did not transpire as sales came in only 4% higher than a year ago and 5% higher than Aug 2024. Prices were resilient following 3 interest rate reductions since the beginning of the summer.

September saw the surge of new listings across all market segments as many home owners that did not sell earlier in the year put the properties on the market in hopes of an autumn rebound. Alas, expectations of even lower interest rates and lack of affordability kept buyers on the sidelines. Meanwhile, properties are taking over 6 weeks to sell on average compared to 4 weeks in prior years. As a result, months of inventory (MOI) has crept up to 5.5 months for the overall market and over 7 MOI for condominium apartments.

Much has been made about recent mortgage reforms aimed at marking properties more affordable. Eligibility has expanded for 30-year amortizations for insured mortgages and increasing the $1M price cap for insured mortgages to $1.5M which will take effect December 15, 2024.

While these policies may spur more sales activity, applying more resources by the provincial government at the Landlord and Tenant Board could have a bigger impact. The case backlog is currently close to 10 months to get a hearing at the Landlord and Tenant Board (LTB). The consequences of the case backlog is a more illiquid market.

Seller and buyers are facing predicaments due to this almost one year backlog. Sellers of tenanted properties are facing haircuts on prices to the tune of 5-10% because landlords cannot guarantee vacant possession of their tenanted property. Investors are taking a pass on residential real estate for fear of not being able to collect rent for up to a year not to mention legal fees when trying to collect or evict a non-paying tenant. Tenants meanwhile are facing extra scrutiny and properties can stay vacant as landlords turn down less than AAA tenants. With fewer private landlords offering rentals, it’s likely that rental prices will rise in coming years.

By hiring more adjudicators, the market becomes more liquid as hearings take place in 2-3 months instead of 10-12 months, thereby alleviating much of the concerns for landlords and investors while making it easier for tenants to find suitable housing.

Shen Shoots the Breeze

Our financially savvy friend Adrian who is an avid reader recommended the book Die With Zero by hedge fund manager and energy trader Bill Perkins.

Before you dismiss this as just another “How to Manage Your Money” book, stay with me for a moment.

The central idea of the book is that we should aim to invest our money in enriching experiences and relationships before we die. Important note: the book is geared toward people with disposable income, whose earnings and assets will likely grow over time.

Perkins’ research suggests that the average person saves far more than they need over their lifetime. Many of us are driven by the fear of not having enough to last, leading to over-saving. He challenges the traditional mindset of working your entire life, saving up, and waiting until retirement to tackle your bucket list. Instead, he advocates for breaking free from the “earn-save-invest” cycle and emphasizes the concept of time-bucketing experiences rather than keeping a bucket list for the end of life.

His research points out that most of us don’t know when we’ve saved enough and unfortunately, by the time we’ve accumulated “enough”, we may no longer be physically able to enjoy the experiences we dreamed of in our youth.

Perkins also introduces the idea of “memory dividends.” He encourages spending more on meaningful experiences while we’re young (not all of our money, of course), explaining that we essentially retire on the memories we create. These memories, rather than a large pile of cash, will bring us immense pride, joy, and nostalgia when we’re older and less able to pursue new experiences.

This could mean donating money to causes we care about earlier in life or spending on experiences like skydiving while we’re young enough to enjoy them fully—because, let’s face it, you don’t see many 80-year-old skydivers. The fear of wasting life should outweigh the fear of running out of money.

Without giving away too much from the book, here are a few things Dave and I are rethinking in our lives:

1. Using what we have now: We’re going through our belongings and deciding what to keep, give to family and friends, or donate. Why save things for “someday” when others could benefit now? If things break while we are enjoying them, such is life – at least it got to be used. Of course, we also recognize people don’t want our junk!

2. Planning for experiences sooner: We’re creating a list of things we’d like to do, either together or with others, and asking ourselves if waiting 10 years would make those things less feasible. For example, I want to improve my wake surfing skills, but I know my body might not be as cooperative in a decade.

3. Contributing earlier to causes and people we value: We are being more intentional to invest in others for skills development so the fruit can be harvested over a longer period of time.