“Thank you March weather. I can’t wait to wake up every day and play the age-old game: pleasant Spring Day or full blown Arctic apocalypse.” Jimmy Fallon, The Tonight Show

As I write this, the mercury measures 2C and I’m looking forward to Spring in just 9 days.

Since January, two comprehensive reports were issued providing insight on buyer preferences: “The Market Year in Review & Outlook Report” by the Toronto Real Estate Board; and “The Annual State of the Residential Mortgage Market in Canada” by the Mortgage Professionals of Canada.

I found that the 2 reports shared consistent themes with my takeaways being:

1) Canadians are becoming more conservative with their choice of mortgage; 2) Canadians have a strong track record of paying mortgages on time; 3) Many Canadians are aggressively shortening their mortgage amortization period; and 4) there is still strong demand for Toronto real estate across various buyer segments.

For those buyers who purchased in 2018, 65% chose a fixed rate mortgage compared to variable rate mortgage. This means that Canadians prefer uncertainty over possible interest savings offered by variable rate mortgages in our uncertain interest rate environment.

Since the 1990s, the mortgage arrears rate ranged from 0.2% – 0.7%. As of September 2018, the rate was near historic lows at 0.24%. The rate is low due to the prevailing low unemployment rate (hovering at 6%) and the low interest rate environment.

Not only are Canadians paying their mortgage on time, Canadians are actively taking steps to lower debt. 1/3 of mortgage holders last year took action to shorten amortization periods (ie. making lump sum payments, increasing regular payments or increasing frequency of payments).

Both reports highlighted the importance of first-time buyer behaviour. This cohort accounts for about half of all sales. The reports were consistent in finding that first-time home buyers have average downpayments of over 20% of the purchase price. Family (aka the parents) fund on average 20% of the total downpayment for these buyers.

Meanwhile, there is still pent up demand as recent buyer surveys reported that up to 1/3 of potential home buyers are likely to buy in 2019 versus 26% from the year earlier.

While these reports are a statistician’s fantasy, the bottom line is that the key driver for real estate is population growth which is expected to increase at an annual pace of 2.0-2.5% in the Greater Toronto Area.

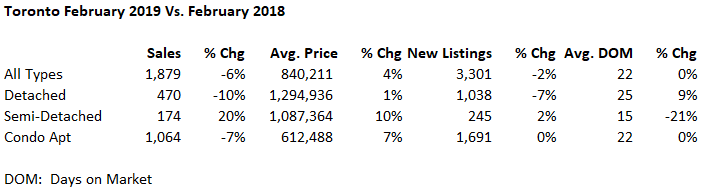

As for the February 2019 Toronto real estate market, there were fewer new listings compared to 2018 resulting in higher average prices.

3 Things I’m noodling through:

- I was listening to a podcast on the future of meat and how two large US based companies (Impossible Foods and Beyond Meat) are offering faux-meat products that look and taste like meat. I enjoy meat but am curious to taste these offerings. Has anyone had a plant-based burger that really tasted like an amazing beef burger?

- Read a pretty depressing article on recycling and now that China no longer wants much of North America’s recyclables, many jurisdictions are finding it difficult to rid their recycling waste and most are ending up in landfills. Expecting more regulations to come on reduction of packaging waste, higher prices and more focus on Reducing and ReUsing.

- Shen and I recently went skiing for the first time in what felt like decades. Signs that I was getting old: new skis technology. Our straight skis are no longer de rigeur. Everyone wears helmets. I know I had a pair of those old-skool bellbottom stretch pants kicking around, but my wife threatened to disown me if I even tried to show up wearing them on the slopes. #oldskoolalltheway

The calendar pages are quickly flying by, and as each day passes, we are reminded that we need to start focusing on our plans for the rest of the year. Maybe you’ve been thinking about moving to a new home, doing a renovation or going on a major vacation. Whatever you may be planning for the coming months, now is the right time to get a head start.

Not only will planning ahead relieve stress later, it will also give you the chance to consider options, do your research and even save money. Plus, the sooner you start, the sooner you’ll start to get excited about all your plans. If I can be of any assistance in moving your plans forward, please don’t hesitate to call.