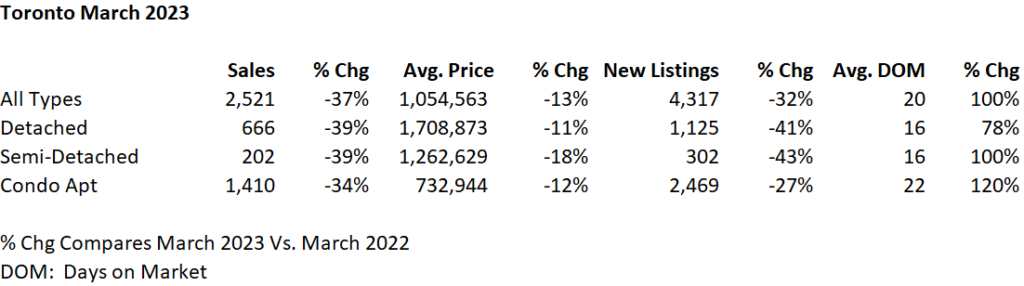

Toronto sales picked up in March as transactions were 45% higher February. When compared to 2022, prices in Toronto were down 13% compared to year ago. This is to be expected as prices in Q1 2022 were historic highs. Transactions are also down 37% as buyers adjust to higher interest rates.

I mentioned last month that it looks like we are past the bottom of the market as market sentiment is firming up. 5-year fixed interest rates dropped from low 5s to high 4s a few weeks ago. The time it takes to sell a property declined from 31 days to 20 days and months of inventory dropped from 3.5 months to 1.7 months since January 2023. Meanwhile, sales-to-new listings shifted from 37% (a buyer’s market) to 58% (balanced market) as multiple offers are becoming common.

Further exacerbating the supply side of the equation is the strong rental market where market rents are up 15-20% compared to Q1 2022.

The province is introducing new housing legislation (Bill 97) which hopes to help the rental market by: building more homes for renters; clearing the landlord and tenant backlog; reinforcing rules against evictions and doubling fines under the Residential Tenancy Act.

My advice to Tenants is to come prepared with a complete package including: full credit check including all lines of credit with score (printed, no screen shots), signed employment letter with recent pay stubs, previous landlord applicable and personal references (ensure personal references have good telephone manner and are expecting to be called). While e-transferring rent is common, most landlords prefer post-dated cheques so having cheques on hand would be beneficial. If a Tenant does not have much rental history or is new to the country, it is helpful if the Tenant writes a letter to the Landlord explaining why they would make a good tenant. If a Tenant is hiring an Realtor to assist with the leasing process, ensure this agent is friendly and personable especially when dealing with the Landlord’s agent. The Landlord’s agent usually has a lot of influence over the leasing process.

For landlords, more than ever, due diligence is critical. I recently helped a landlord at the Landlord and Tenant Tribunal case who was owed $16,000 in rent. The case took 7 months to get a hearing. Even though the hearing was online, our case almost didn’t get heard due to the backlog which would have meant waiting another 4 months to get a hearing. Even if the tenant signs an N9 Form – Tenant’s Notice to End the Tenancy and the tenant later changes their mind, it’s not enforceable.

In the above case, the tenant agreed to move out but the Landlord needed to extend the tenancy by 3 months. At time of writing, the tenant defaulted on the payment plan but even the eviction process can take a few weeks. If the landlord decides to recoup the outstanding rent, they will need to take the tenant to Small Claims Court.

My advice for landlords deciding on Tenants is the same given in the movie Indiana Jones and the Last Crusade by the Templar Knight to Indy when deciding amongst the different cups to drink from: “Choose Wisely”.