Toronto’s February market was more active than a year ago. Transactions increased on average by 13% with freehold properties leading the way reporting double digit sales growth as condo apartment sales increased by 7%. Prices stayed at similar levels as more listings came on the market.

More importantly, momentum from January continued into February as average prices increased by 11% month on month while transactions increased by 34%. Pent up demand from last year is fueling the market with population growth and expectations for interest rate reductions this year. Properties are selling quicker than with months of inventory dropping from over 4 months in Q4 2023 to its current level of 2.5 months. As a result, we find ourselves in a balanced market with sales-to-new listings ratio (SNLR) at 45% compared to the buyer’s market in Q4 2023 when SLNR hovered around 30%.

As confidence returns to the real estate market, more Sellers will enter the market which I expect will lead to brisk activity in 2024’s spring market.

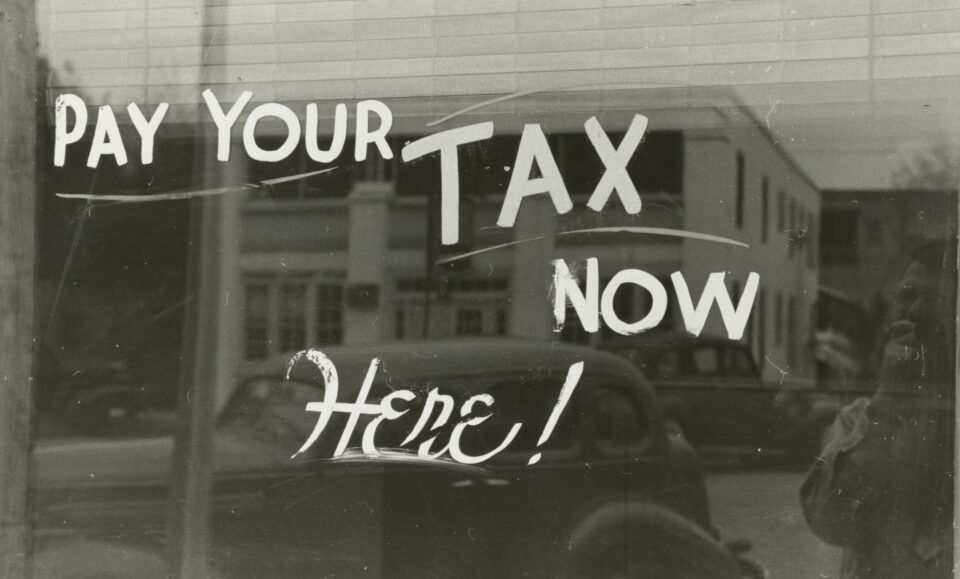

While affordability will continue to be a challenge, the friction in the form of real estate related taxes from all levels of government will be another impediment to a smooth real estate market. Here’s a list of regulations and taxes affecting Toronto’s real estate market.

- Federal Underused Housing Tax (UHT) – annual 1% tax on the ownership of vacant or underused housing in Canada that came into effect January 1, 2022.

- Federal Prohibition on the Purchase of Residential property by Non-Canadians Act which prohibits residential property by non-Canadians until at least January 1, 2025.

- Federal Residential Property flipping rule. Effective 2023, profits from the disposition of flipped property are taxed as business income

- Federal government denying expenses as write offs on short term rentals as of January 1, 2024.

- Ontario land transfer tax is a graduated tax that ranges from 0.5% to 2% of the property value when land or interest in land is purchased in Ontario.

- City of Toronto land transfer tax is a graduated tax that ranges from 0.5% to 7.5% of the property value when land or interest in land is purchased in Toronto

- City of Toronto property tax which includes city tax, education tax, city building fund ranging from 0.67% to 2.17% of the assessed value in 2023.

- City of Toronto development charges, lot levies and parkland charges imposed on land development.

- City of Toronto Vacant Home Tax (increased from 1% to 3% in 2024) which applies to residences that are vacant for more than six months. (Reminder that March 15, 2024 is the last day to make your 2023 declaration)

There’s also the 13% Harmonized Sales Tax which applies to goods and services related to real estate including labour and materials, permits, legal and sales etc.

The provincial and federal budget will be coming out in the next month with housing as a top priority. Stay tuned.

In the meantime, we can contemplate on what US Supreme Court justice Oliver Wendell Holmes wrote more than 100 years ago. “Taxes are the price we pay for a civilized society”. If this is true, this should make Toronto one of the most civilized places to live and play. The jury is still out.

Until next month and now over to Shen…

Shen Shoots the Breeze

We just returned from our Orlando family trip. I love the Disney and Universal theme parks for their thoughtfulness and creativity. We get it comes with a hefty price tag. Last month, we wrote about our plans and some of you asked for more tips now that we’ve returned.

What we would do again:

We enjoyed staying at the resorts. Disney has resorts for budgets of all sizes. We stayed at the Pop Century resort as reviews indicated it was the best bang for your buck. It was very close to Disney Hollywood Studios (DHS) and we could get there via the complimentary gondola system called Skyliner. It is considered one of their value resorts. Although the rooms were small, they were efficiently laid out.

We were celebrating some family member birthdays and it was a nice touch to be welcomed with birthday buttons and a personalized birthday greeting on the TV at check in.

I love how we didn’t need to line up at the front desk to check in as Disney notified us via their app when the room was ready. They also have free self-parking (can you envision Dave doing a double fist pump). So upon arrival, we were in our hotel rooms within 15 minutes.

Disney’s transportation is top notch. We left our car in the lot and took the Skyliner to the DHS. The next day while the teenagers slept in, the adults took the Skyliner to catch the views and also one of the Friendship boats to the Boardwalk Villas and finally a bus to Disney Springs – all complimentary for hotel guests.

If we had more time, we would have gone to the other resorts.

We were really happy with the stroller rental. We booked thru this company. Their price includes drop off and pick up. It was great to not have to lug each other’s water bottles and we left our sweatshirts and a ton of snacks in the bottom storage compartment. There are so many areas we could leave the stroller when enjoying rides. At the end of the day, the stroller proved extra useful as it was something we could lean on while using what little energy we had to go back to the hotel.

Early birds get the biggest worms. The parks reward early birds. Disney and Universal allow their resort guests early park admission. We were up at 6am to get as close to the front entrance as possible so we could go on the popular rides. We were inside DHS grounds at 7:45 am – even though it states 8am is when the park opens to resort guests. Universal provided us 1-hour early access and we were at the gate almost an hour before they allowed early park admission. If staying at one of Universal’s premium resorts don’t wait for the water taxi, just walk. It’s faster and so you’ll get to the front of the line.

Ride the Universal rides, skip some Disney ones. Universal rides are generally much more exciting than Disney’s.

Time is money. If your budget allows, stay at one of the Universal resorts that offers the Universal Unlimited Express Pass; otherwise purchase the Universal Express Pass a la carte! We saved a ton of hours not having to do the big lineups especially at the popular rides.

Family portraits with the Genie+ purchase. We were surprised how much all of us got into getting our photos taken by the Disney photographers – they even have photographers at Disney Springs. With Genie+ app, we could link our entire family to see each other’s photos. I paid the CAD 99 to get our photos downloadable and got some amazing shots!

What We Avoided

Dining Plans. We thought about purchasing the Disney dining plan but even with teenagers it just didn’t make sense. We did quick service for lunch and decided to catch dinner off Disney grounds. Most of our snacks were purchased offsite and brought in.

Restaurant line ups. Make reservations – we did for Oga Cantina (DHS) and also at Toothsome Chocolate Emporium (Universal City Walk). The apps also allow you to change reservation times easily. We also went a little earlier for lunch in Harry Potter Hogsmeade – if you’re a large group, get the Great Feast menu item ($73) at Three Broomsticks – it can easily feed 7-8 people. If you go around noon time, you could be waiting over 45 minutes without a reservation.

Loading up the week. We enjoyed doing a park one day and having a ‘rest’ day the next day. We could sleep in, enjoy the resort amenities, and have a leisurely meal. Also helps if your feet aren’t barking from doing back-to-back days pounding the pavement.

And finally, cheapskate hacks

Soda refills are available if you save the disposable cup. We paid Disney over $3,000 in tickets, resorts, food etc… we felt they didn’t need any more of our money for soda but let’s just say that cup was really, really hardworking.

Skip Magicbands – your phone can do the same thing. It’s one more thing that’ll collect dust when you get home.