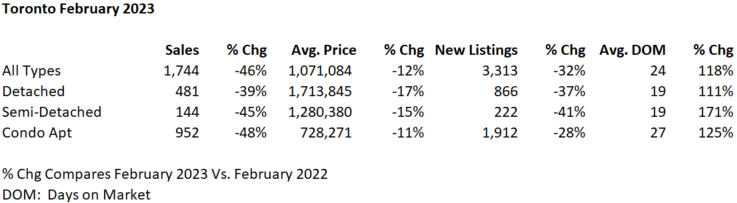

Toronto’s real estate market showed signs of life. Transactions were down ~45% from pre-rate hike levels of early 2022 while prices fell ~12% compared to last February.

Although these results are down, they followed the cautious optimism I wrote about last month and it feels like we’ve hit the bottom of this downturn in terms of prices. I was telling clients over the weekend that over the past 4 weeks, I’m seeing appointments pick up, multiple offers and properties were lagging on the market, sell. Buyers who have been on the side lines are coming back into the market believing that mortgage rates are stabilizing ~5.0%-5.5%. These buyers are comfortable that after seeing 20%-25% price declines, there isn’t much more room for prices to fall as supply is tight and immigration will continue to support the housing market.

This is consistent with the Ipsos buyer intention surveys conducted in Q4 2022 which showed that there was an increasing number of respondents compared to Q4 2021 who were considering buying a home in 2023. Furthermore, first time buyers expressed more willingness to buy a home this year.

While the market may be bolstered by new buyers, my clients pointed out that inflation is highly problematic for household finances. In addition, current home owners who bought their home sevweral years ago will struggle to renew their mortgages at existing higher rates. As a result, they think this recent activity may just be a “bull trap” – when a short-term rally during a downtrend “traps” the buyers who mistake it for the start of a new uptrend.

To get a better sense of what buyers are facing upon renewal, let’s take a look at what they face in 2023. The majority of mortgages coming due this year would be for properties bought in 2018 as most buyers took on 5-year fixed rate mortgages. The table below outlines the cost of housing and minimum qualifying income in 2018 compared to what it would be today.

Scenarios:

- In 2018, the average home price was $835,000. Assuming a 20% downpayment, the resulting mortgage of $668,000 required monthly and annual mortgage payments of $3,341 and $40,087 respectively (3.49% interest, 25-year amortization). Minimum qualifying income would be $162,000.

- The home owner renewing their mortgage in 2023 from the same lender does not need to re-qualify under the stress test but would need to pay current interest rates of 5.35%. The monthly mortgage and annual mortgage payments would increase by $702 and $8,423 respectively after renewal.

- The home owner could also re-finance to lower their mortgage payment with the additional equity in the property as average prices increased by 25% since 2018. After paying the down the original mortgage of $668,000 for 5 years, the remaining mortgage is $575,000. The home owner can refinance the property now valued 25% more at $1,040,000. When refinancing, the buyer also needs to requalify their income at a higher rate (ie, 7.35%). Monthly mortgage and annual mortgage payments would increase by $139 and $1,669 respectively after refinancing compared to their original 2018 mortgage. Annual qualifying income would need to increase from $162,000 to $180,000 between 2018 and 2023.

Observations:

The cost of housing is higher in 2023 compared to 2018. The renewal option comes at a higher cost due to higher interest rates resulting in higher annual mortgage costs of $8,423. If the home owner’s income has increased and can qualify at the higher qualifying rate, they could lower their mortgage payments by $6,754 a year by refinancing instead of renewing.

I believe home owners will do almost anything to keep their properties and I don’t see additional annual mortgage costs of $1,700-$8,500 triggering home owners to sell their principal residences.